Morgan Stanley MyDesk: Secure Access & Financial Planning

Is the promise of financial security in retirement a dream within reach, or a daunting reality? For those navigating the complexities of modern finance, especially within the framework of a global institution like Morgan Stanley, understanding the tools and resources available is paramount to securing a financially sound future.

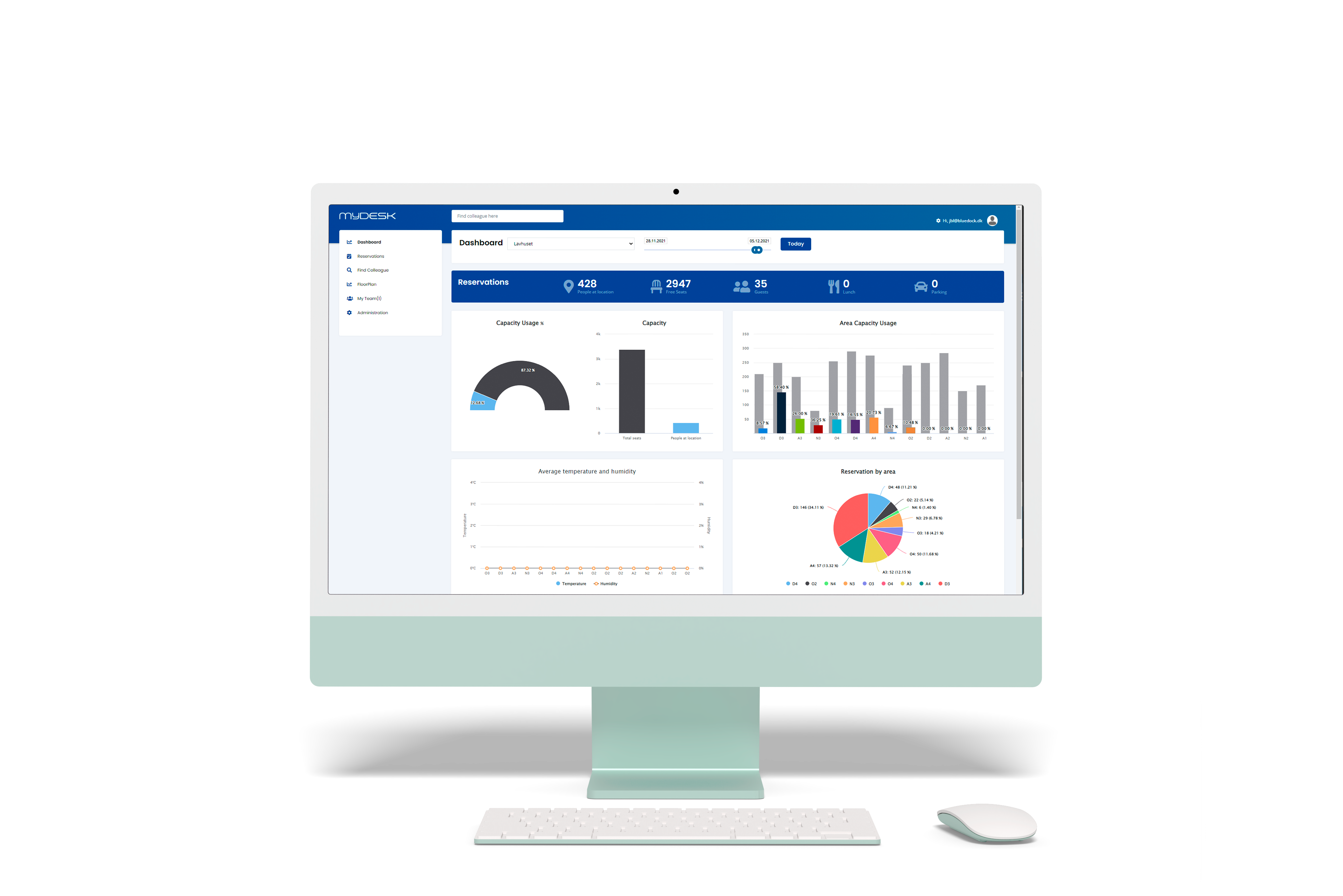

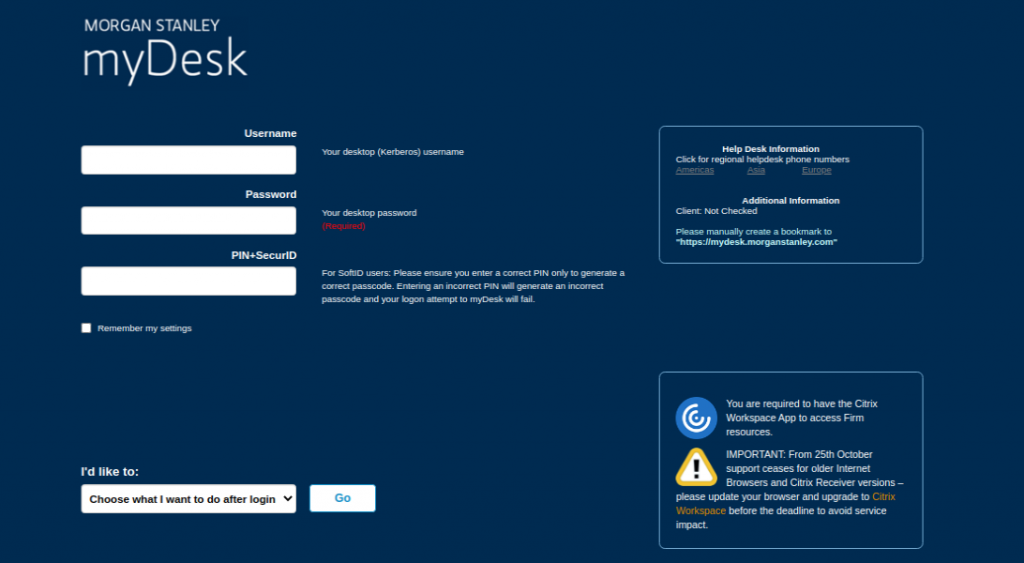

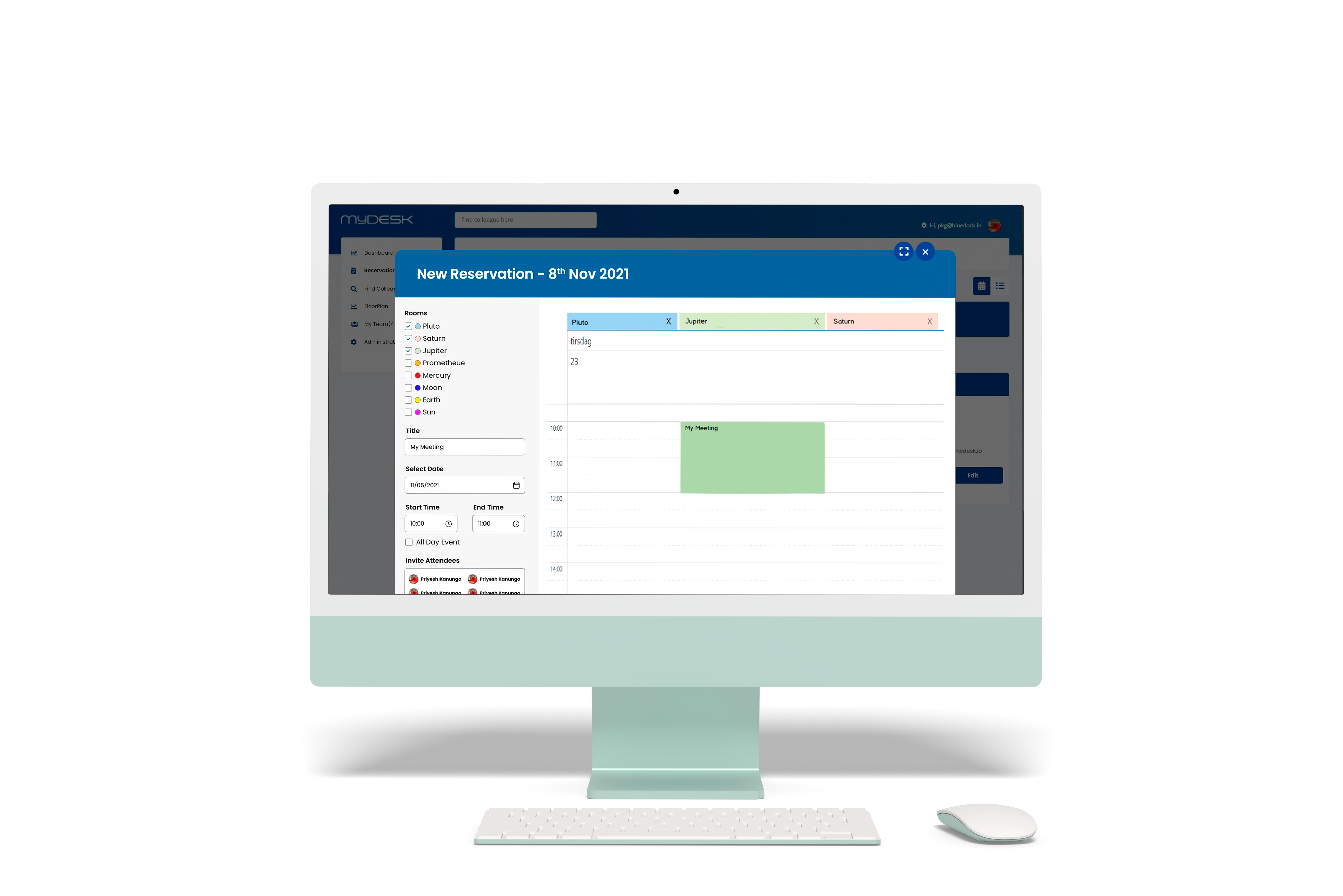

The digital landscape of finance has become increasingly intertwined with our daily lives. The ease of access afforded by platforms like Morgan Stanley's MyDesk services offers both incredible convenience and a heightened need for diligence. The ability to remotely access desktops, applications, and financial instruments is a cornerstone of modern work, but with it comes the responsibility of safeguarding personal and financial information. This digital accessibility demands a robust understanding of the security measures in place and the best practices for navigating these platforms.

The foundation of any successful financial strategy, especially when planning for retirement, hinges on the ability to take control of your financial future. Morgan Stanley provides a portal, a digital gateway, to managing workplace financial benefits, and access to tools to help create and implement robust retirement plans. This includes access to stock plan accounts, as well as resources designed to educate and empower individuals to make informed decisions about their financial well-being. The availability of such resources highlights the importance of proactive financial planning, urging individuals to actively engage with their financial future rather than passively observing it.

For those seeking specific support and assistance, the platform offers a clear pathway. Selecting the appropriate benefit and platform can lead users to the specific resources they require, simplifying the process of navigating the complexities of financial management. This user-friendly approach is particularly important in the fast-paced world of modern finance, where time is a valuable commodity. The ability to quickly and efficiently access relevant information is key to maintaining a sense of control and confidence.

Within the framework of Morgan Stanley's digital ecosystem, MyDesk stands as a pivotal access point. It is the gateway for remote work, providing employees with a secure and efficient means of accessing the tools and resources they need to perform their duties. The emphasis on secure access is not merely a technical detail; it reflects a fundamental commitment to protecting sensitive information and maintaining the integrity of the financial institution. This focus on security should encourage trust and provide employees with peace of mind as they conduct their daily activities.

A key component of financial well-being, particularly as it relates to the services provided by companies like Morgan Stanley, is the need to plan for retirement and the importance of being secure about finances. Resources and tools for employees are available to plan for retirement, and these are essential for securing a financially sound future. These financial solutions, combined with secure remote access options and other financial tools, give employees the knowledge and the capability to manage their assets and achieve their financial goals, now and in the future.

It's important to understand the terms associated with financial institutions. Morgan Stanley Smith Barney LLC is a registered entity, and the mention of "member SIPC" indicates that client accounts are protected, up to specific limits, in the event of a brokerage firm's insolvency. This is a crucial safeguard designed to provide investors with an added layer of security.

The commitment to security, accessibility, and resource availability is central to Morgan Stanley's platform. Whether it's a secure logon page, access to MyDesk services, support for stock plan accounts, or assistance with retirement planning, the company aims to empower its users to manage their financial lives confidently and efficiently. And as the digital landscape evolves, staying informed about the latest advancements in security, available tools, and financial strategies is the key to financial stability and growth.

Please note that while steps are taken to ensure a secure environment, there are inherent risks in online activities. Users are encouraged to exercise caution and diligence when accessing online platforms, especially those handling sensitive financial information. Regularly updating passwords, recognizing phishing attempts, and keeping security software up to date are vital components of responsible online behavior. Remember, the combination of robust infrastructure and user awareness is the strongest defense against online risks.

Compatibility is a critical factor in any digital platform. The note about internet browser compatibility suggests that users should ensure their browsers are up to date to avoid any possible issues with access or functionality. Keeping browsers updated also helps the platform manage their financial benefits and to navigate the complexities of workplace benefits management and financial planning.

Adult content indicators availability or unavailability of the flaggable\/dangerous content on this website has not been fully explored by us, so you should rely on the following indicators with caution.

To reiterate, the importance of financial security. Those involved in the financial sector, especially employees of Morgan Stanley, need to understand the resources and tools available for achieving financial stability, particularly in retirement. This understanding is paramount. The journey to a financially secure future is within reach for anyone willing to learn and adapt.

In the context of modern financial institutions, the balance between offering access to cutting-edge tools and safeguarding sensitive information is important. Morgan Stanley's MyDesk platform and its resources, especially those for remote work, represent this balance. Through secure access, up-to-date security measures, and a wide range of financial planning tools, users can feel confident in accessing and managing their resources. This helps employees and clients make smart decisions. By ensuring secure access to workplace resources and stock plan accounts, Morgan Stanley reinforces its commitment to both accessibility and security, facilitating the efficient management of financial benefits.

When accessing these resources, users should stay vigilant. Utilizing current browsers, recognizing signs of phishing and staying aware of security risks are all crucial aspects of responsible use of an online platform. This combined approach allows Morgan Stanley users to access the benefits of financial management in a secure, trusted environment.

At its core, the purpose of this content is to help the audience in the financial industry with knowledge of the tools and resources provided by institutions like Morgan Stanley. It emphasizes the importance of financial planning, secure access, and the tools available for those looking to manage their financial futures.