Morgan Stanley MyDesk: Access & Troubleshoot - Quick Guide & Tips

Are you seeking seamless access to your financial world, allowing you to manage investments, plan for the future, and stay connected to your professional resources from anywhere? The answer is a resounding yes, and the key lies in understanding the modern tools that empower financial agility and secure access to crucial platforms like Morgan Stanley's services.

In today's fast-paced environment, the ability to manage finances and professional responsibilities remotely has become paramount. The demands of modern life necessitate flexibility and accessibility, ensuring that individuals can maintain control of their financial well-being and professional engagements regardless of their location. Services such as Morgan Stanley's mydesk and the online platforms associated with managing share plans, equity awards, and professional resources have emerged as critical components of this shift. These tools not only allow access to essential information but also facilitate proactive planning and decision-making.

The journey to financial security and professional empowerment is significantly shaped by understanding the resources available to you. From securely accessing your Morgan Stanley desktop and applications through mydesk to exploring retirement planning and utilizing platforms such as Morgan Stanley at Work, each tool contributes to a holistic financial strategy.

Consider this piece dedicated to Seth Hurwitz, a financial professional who provides insights and services through the lens of Morgan Stanley. It aims to provide clarity and a deeper understanding of the advantages and benefits these platforms offer.

| Category | Details |

|---|---|

| Name | Seth Hurwitz |

| Profession | CFP and CFA Professional |

| Role at Morgan Stanley | Financial Planner, Portfolio Manager, Lending Services |

| Key Services | Financial Planning, Portfolio Management, Lending |

| Expertise | Market Insights, Megatrends, and Contact Information |

| Platform | Morgan Stanley |

| Primary Focus | Helping clients secure a financially sound future |

| Location/Availability | Contact Information provided through Morgan Stanley channels |

| Educational Background | Assumed to have relevant degrees and certifications (CFP, CFA) |

| Years of Experience | Information not explicitly provided, but assumed to have significant experience based on professional designations and services offered |

| Link to Reference | Morgan Stanley Official Website |

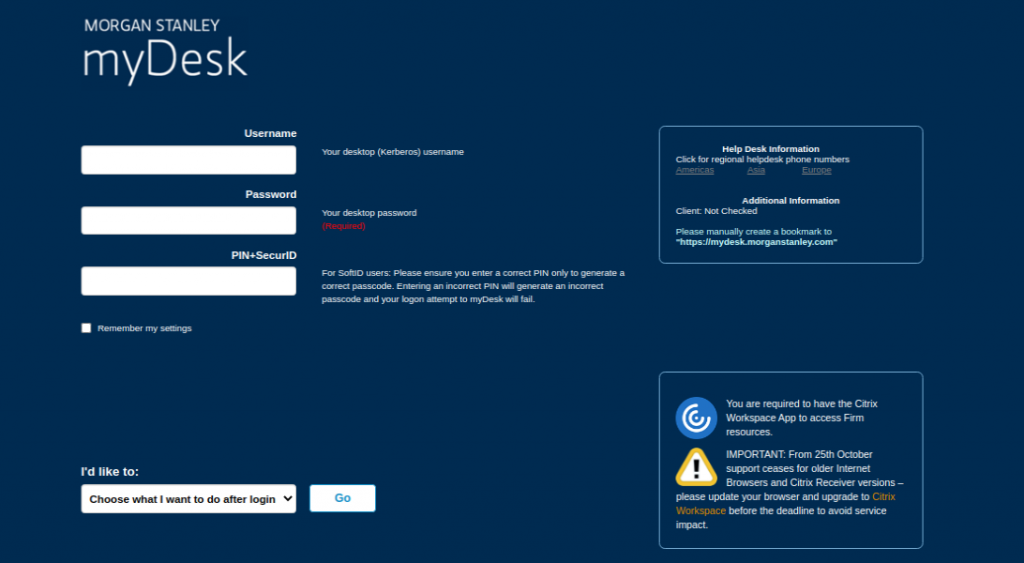

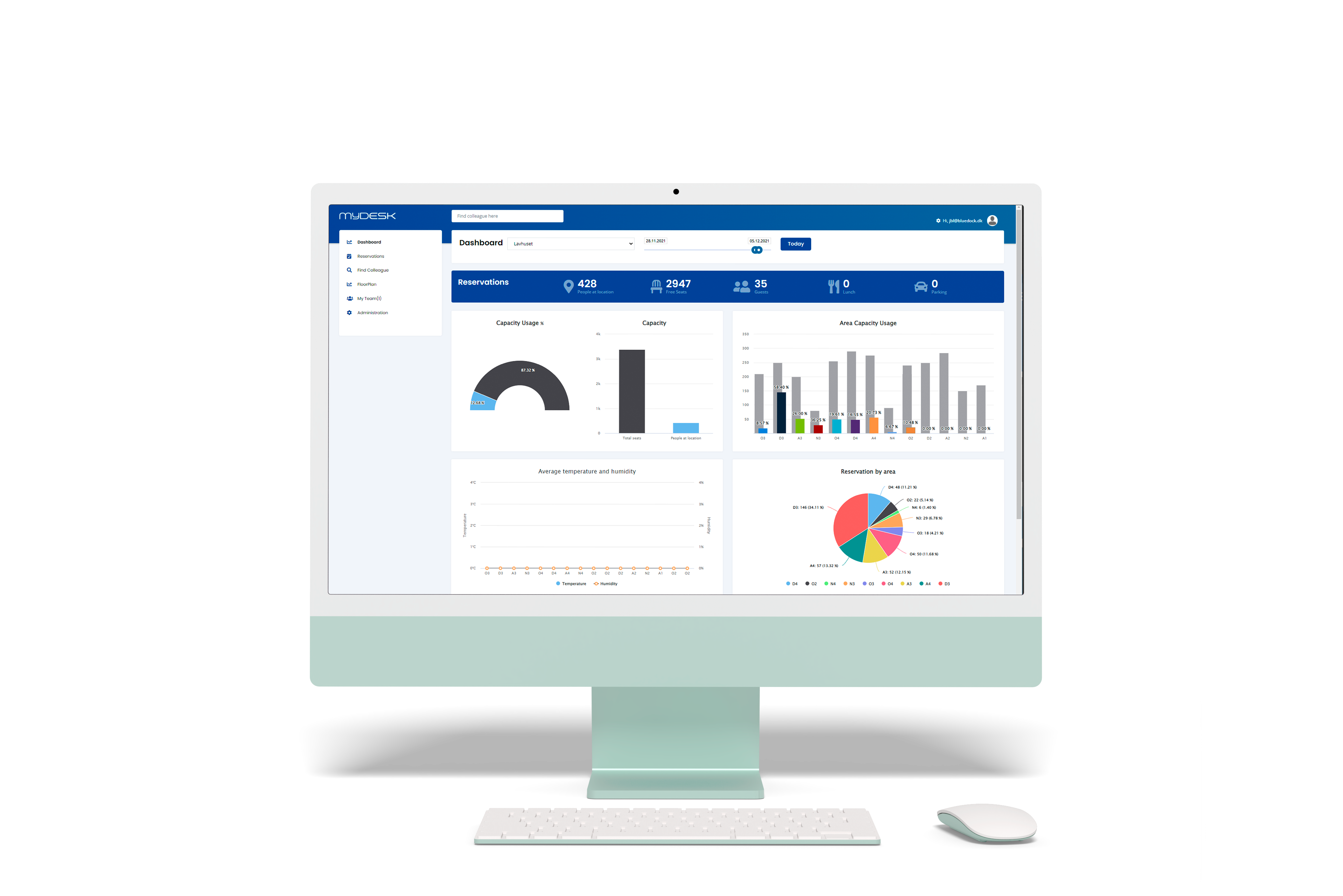

Navigating the intricacies of financial services often requires a secure and reliable platform. Morgan Stanley's "mydesk" provides this secure entry point, allowing users to remotely access their desktop environments and work applications. This is crucial for maintaining productivity and staying connected to the necessary resources, regardless of physical location. Whether you are at home, traveling, or in a hybrid work environment, the ability to securely access your work from anywhere is essential.

The importance of secure access cannot be overstated. In a world increasingly threatened by cyber security risks, knowing that your connection is encrypted and protected becomes a necessity. Logging in with your credentials ensures that only authorized users can access your information. This level of protection provides the necessary peace of mind to confidently manage your finances and other critical data.

Beyond immediate access, the ability to proactively plan for retirement is a cornerstone of financial health. Exploring resources focused on securing a financially sound future is essential. Morgan Stanley, as a leading financial institution, offers tools and resources to help individuals plan for their retirement journey. These resources may include financial planning tools, educational materials, and expert advice from financial professionals.

The "Morgan Stanley at Work" platform provides a centralized hub for employees to access their workplace financial information and resources. This includes benefits information, retirement planning tools, and access to financial advisors. The ability to consolidate all of this information into one place simplifies the management of finances and benefits, streamlining the process and saving time.

The experience of managing your finances is further enriched by the capabilities of logging in with your username and password, or by creating a new username if you dont have one. For individuals managing share plans or equity awards, dedicated accounts provide tailored access to manage these benefits effectively. The process of accessing your Morgan Stanley account and managing your investments and finances online is made seamless by these dedicated portals.

When encountering issues with account access, its critical to have support options readily available. You can reset your password if you forget it, or contact customer service for additional help. Customer service is often accessible through various channels, including phone, email, and online chat support, to help resolve any technical issues or account-related concerns.

For first-time users of these platforms, the process may begin with an email containing a username and temporary password. This ensures secure initial access and facilitates the creation of a personalized and protected account. Following this initial setup, users can customize their settings and explore all the available features tailored to their specific needs.

Understanding the implications of remote access extends beyond simple convenience. The "mydesk" platform, in particular, provides secure access to your Morgan Stanley desktop and applications from anywhere. This is a significant advantage for remote work, ensuring that employees have uninterrupted access to their essential work tools and data. This seamless integration contributes to increased productivity and flexibility in modern work environments.

While discussing the accessibility and capabilities of the Morgan Stanley platforms, it is important to acknowledge the role of cybersecurity. The constant threats in the digital landscape mean that platform security is of paramount importance. The methods employed to keep user information secure include encryption, multi-factor authentication, and regular security audits. These safeguards minimize the risk of unauthorized access, ensuring financial and data security.

When considering the technical aspects of accessing these platforms, it's also beneficial to be aware of potential technical issues. One user reported encountering issues with "mydeskshield" on Windows 11, and other technical issues like the "duplicate SID entry" that could potentially interfere with software installation or the overall user experience. The importance of troubleshooting and seeking assistance from IT support or customer service when encountering these challenges is highly important.

Furthermore, the user experience and functionality are crucial. The ability to sign in using your username, account number, email address, or employee number enhances ease of use. This flexibility ensures quick access to essential financial tools and resources, streamlining the login process.

The role of financial professionals, such as Seth Hurwitz, is equally important in the process. These advisors offer financial planning services, investment management, and lending services. Their expertise helps clients to navigate the complexities of financial planning and achieve their financial goals. This personalized guidance is an integral part of a comprehensive approach to financial management.

There is also a need for vigilance against deceptive practices. It is always advisable to confirm the legitimacy of any communication, especially requests for sensitive information. Always use the official Morgan Stanley website or trusted contact channels when managing your account, and be wary of suspicious emails or links. Staying alert is crucial in the fight against phishing and other scams.

While technical issues and security concerns are addressed, the fundamental goal remains providing an effective and user-friendly platform. Morgan Stanley's efforts to offer secure access to essential tools and services underscores its commitment to meeting the evolving needs of its clients and employees in an increasingly dynamic financial landscape. The constant efforts to enhance security protocols, streamline user experience, and provide expert financial guidance further enhance the value proposition of these platforms.

In conclusion, the integrated ecosystem of Morgan Stanley's platforms and financial professionals offers a pathway to both financial security and professional empowerment. Through secure access, retirement planning resources, and the personalized guidance of experts like Seth Hurwitz, individuals are empowered to confidently navigate their financial journeys, achieve their goals, and stay connected in an ever-evolving world.