Tri City National Bank Routing Numbers & Info: Find Yours Now!

Are you seeking clarity on the intricacies of financial transactions and the essential codes that underpin them? Understanding bank routing numbers is not merely a technical exercise; it is a fundamental requirement for navigating the modern financial landscape with confidence and precision.

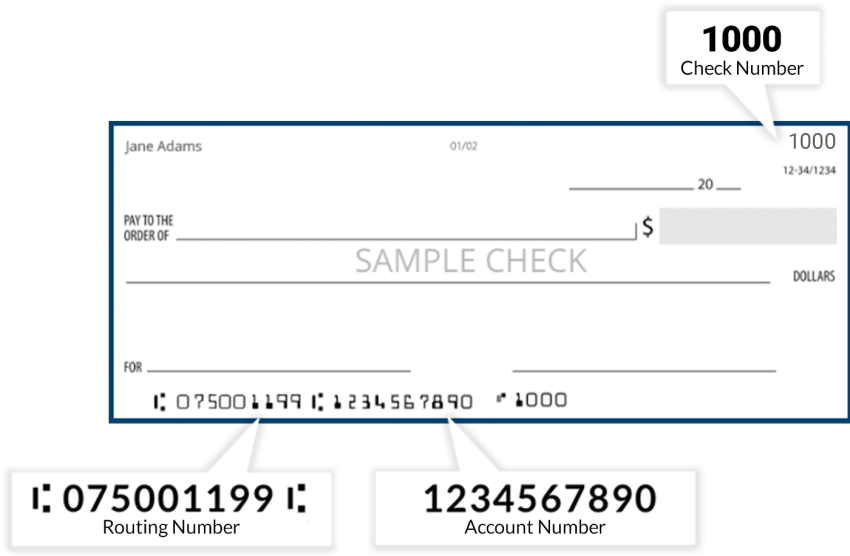

Bank routing numbers, those seemingly random nine-digit codes, are the lifeblood of the US banking system. They are instrumental in directing funds electronically between financial institutions, enabling everything from direct deposits to wire transfers. These numbers are assigned to banks and credit unions by the American Bankers Association (ABA), serving as a unique identifier for each institution. For anyone involved in financial transactions, whether personal or business, a firm grasp of how routing numbers work is paramount. This knowledge ensures that funds are directed to the correct destination and avoids the potential pitfalls of misdirected payments.

Let's delve into a specific example: Tri City National Bank. While the exact history of this bank might not be readily available at this moment (as we do not have detailed information), we can still use it as a framework to explain how routing numbers function. Tri City National Bank, like all other financial institutions in the United States, operates using a specific set of routing numbers.

One of the critical routing numbers associated with Tri City National Bank is 075001199. This particular number is crucial for anyone transacting with the bank, as it facilitates both ACH (Automated Clearing House) and Fedwire payments. ACH transfers handle a wide range of transactions, including direct deposits, bill payments, and other electronic funds transfers, while Fedwire is primarily used for large-value, time-sensitive transfers. Therefore, knowing the correct routing number is essential for the seamless execution of these transactions.

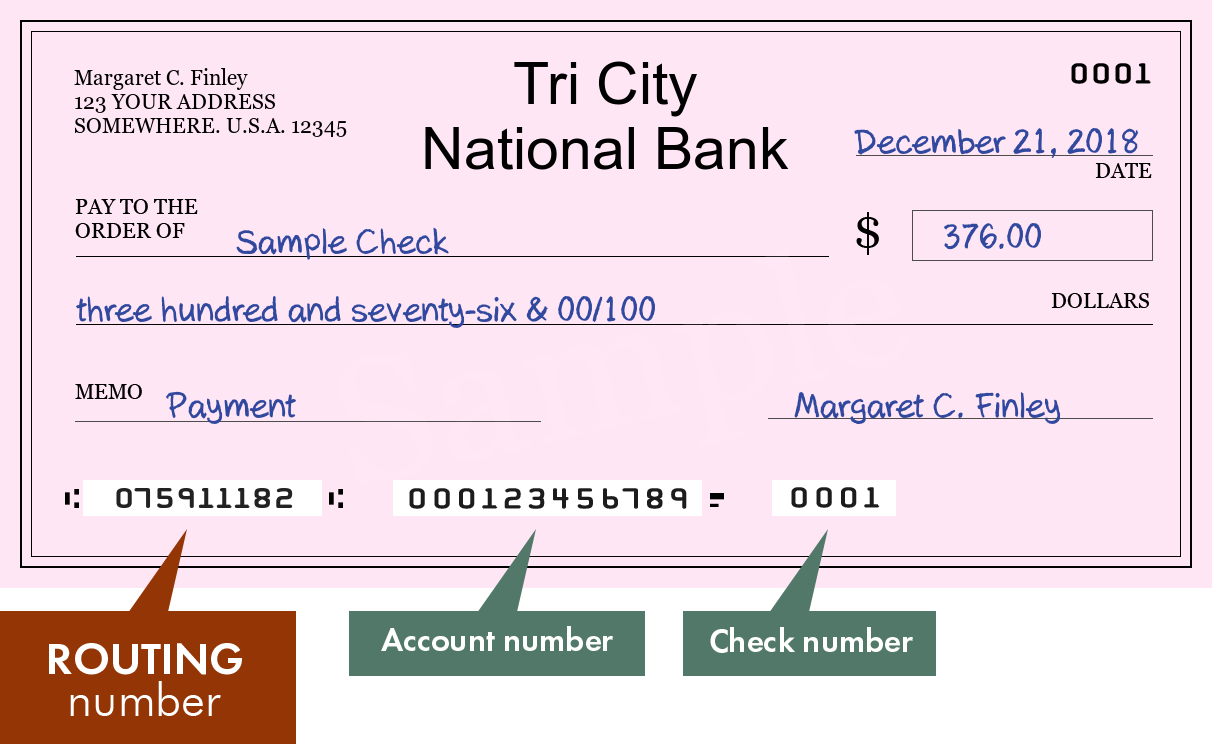

Another routing number linked to Tri City National Bank is 075911182. This number is assigned to the bank's branch located in West Allis, Wisconsin. This highlights an essential aspect of the routing number system: while a bank may have several routing numbers depending on the location, each one is uniquely tied to a specific branch or function within the institution. Using the wrong routing number can lead to significant delays or even the rejection of a transaction, so accuracy is of the utmost importance.

Tri City National Bank, and indeed all banks, uses routing numbers for a variety of purposes:

- Facilitating ACH Transfers: The routing number is essential for processing ACH transactions, which are used for direct deposits, bill payments, and other electronic transfers.

- Enabling Wire Transfers: Routing numbers are vital for sending and receiving wire transfers, allowing funds to be moved quickly and securely between different financial institutions.

- Processing Electronic Payments: They are integral to various electronic payment systems, ensuring that payments are routed to the correct destination.

It is worth mentioning that according to the provided information, Tri City National Bank has a total of two routing numbers on record. However, it's important to always verify the most current information with the bank directly, as routing numbers can change. Given the information available, one can deduce that Tri City National Bank is equipped to handle a broad spectrum of financial transactions, ranging from standard electronic transfers to more complex wire transfers.

For those seeking to make payments to or receive payments from Tri City National Bank, it is very important to have the most up-to-date routing information. Always verify the routing number with the bank itself, especially for any transactions that require a high degree of accuracy. It is always wise to check the accuracy of the routing number you intend to use, as using an incorrect number can create significant challenges.

To further illustrate the use of routing numbers, let's consider a hypothetical situation. Imagine a customer of Tri City National Bank in Oak Creek needs to receive a payment from an external company. To ensure the funds arrive at the correct account, the customer must provide the company with the correct routing number for their Oak Creek branch (likely 075001199, but verification is essential). Providing the correct routing number, in conjunction with the account number, is necessary for the transaction to be processed accurately.

Furthermore, the bank offers various services at different locations such as Oak Creek at 6400 S. The provision of such services further highlights the important role that routing numbers play in facilitating transactions across these different branches. The routing number also identifies the specific branch or location where funds are being sent or received. For example, routing number 075001199 is used for Tri City Nat'l Bank in Wisconsin. This ensures the correct branch receives the financial transaction.

Routing numbers are a key element that support electronic financial transfers by ensuring the correct delivery of funds from one institution to another. This process is essential for enabling the smooth operation of the modern economy.

The information provided about Tri City National Bank is derived from the information that was provided, and it's imperative to verify the accuracy of these details by directly contacting the bank.

| Aspect | Details |

|---|---|

| Routing Number 1 | 075001199 |

| Associated Bank | Tri City National Bank |

| Functionality | Facilitates ACH and Fedwire payments |

| Routing Number 2 | 075911182 |

| Location | West Allis, WI |

| Use | ACH and Fedwire funds transfers |

| Branches | Oak Creek, St. (as per the available information) |

| Number of Routing Numbers | A total of 2 on record |

The purpose of this article is to illuminate the important role of routing numbers within the financial structure, particularly in the context of Tri City National Bank. Although not much information has been provided about the bank other than its routing numbers and location, the discussion surrounding the application of these numbers is applicable to all banks across the United States. By understanding the significance of these nine-digit codes, individuals and businesses alike can conduct their financial transactions with enhanced efficiency and security.