Guide To Investments: Stocks, Bonds & More - Your Path To Prosperity

Are you ready to unlock the secrets of building lasting wealth? Understanding the diverse world of investments is the cornerstone of financial security and a key to achieving your long-term goals.

This guide, updated on February 20, 2024, and again on July 10, is designed to demystify the world of investments, providing a comprehensive overview of different asset classes and strategies. We'll explore how various investment types work, their potential benefits, and the risks involved, empowering you to make informed decisions that align with your financial objectives. Whether you're a seasoned investor or just starting out, this is your roadmap to navigating the complexities of the market and building a robust portfolio.

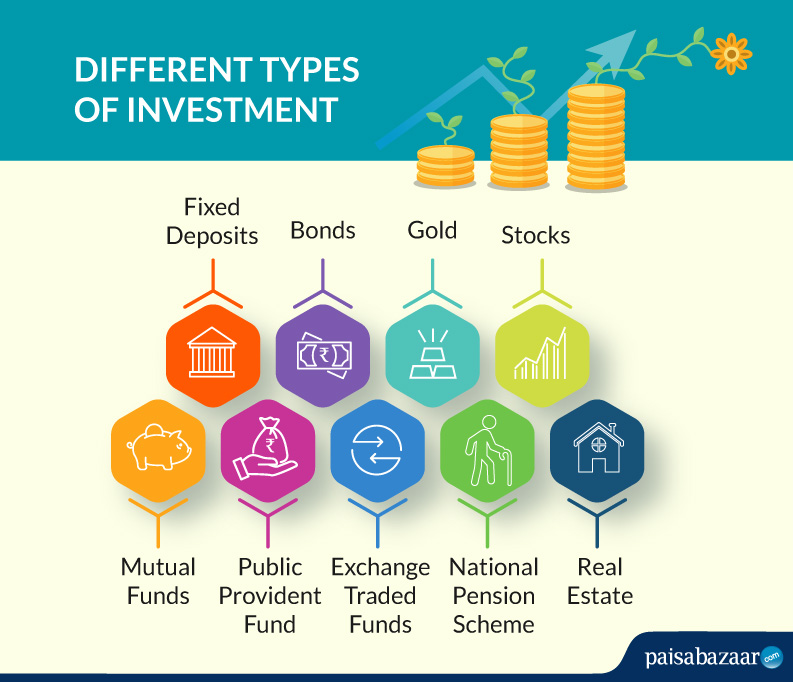

Our journey begins with a deep dive into the fundamental building blocks of any successful investment strategy: stocks. Stocks, representing ownership in a company, are a core component of many investment portfolios. We'll discuss the advantages and disadvantages of stock ownership, understanding that when you buy a stock, you're essentially purchasing a share of the company's future. But before we get too deep into the details, let's zoom out and look at the various types of investments that are available.

Here's a table outlining some key information on investment types:

| Investment Type | Description | Risk Level | Potential Returns | Examples |

|---|---|---|---|---|

| Stocks (Equities) | Represent ownership in a company. | High | High | Shares of Apple, Microsoft, etc. |

| Bonds | Loans to governments or corporations. | Moderate | Moderate | Treasury bonds, corporate bonds |

| Mutual Funds | Pooled investments managed by professionals. | Moderate | Moderate | Index funds, actively managed funds |

| Exchange Traded Funds (ETFs) | Similar to mutual funds but trade like stocks. | Moderate | Moderate | S&P 500 ETF, sector-specific ETFs |

| Real Estate | Ownership of property. | Moderate to High | Moderate to High | Residential, commercial properties |

| Alternative Investments | Includes hedge funds, private equity, commodities, and cryptocurrency. | High | Variable | Hedge funds, gold, Bitcoin |

| GICs (Guaranteed Investment Certificates) | Fixed-term investments with guaranteed returns. | Low | Low to Moderate | GICs from banks and credit unions |

Understanding these categories is critical for creating a diversified portfolio. A well-diversified portfolio spreads investments across multiple asset classes, mitigating risk and enhancing the potential for long-term growth. For beginners, there are many resources to explore, from online investment platforms and educational websites to the advice of financial professionals, such as the team at Prosperity Club.

Since 2021, Prosperity Club has been expanding its website to include information from experts across various fields, including housing, investments, and taxes. They offer insurance products through Deborah Armstrong, a licensed agent, and her team of nationwide agents. Prosperity Clubs mission is to make education, housing, insurance, and legal services accessible to everyone. The organization focuses on income, but recognizes that income is not the only measure of financial success. The team at Prosperity Club understand there are plenty of people with money that live paycheck to paycheck, burdened by debt. They are committed to providing the knowledge and tools necessary to empower their members. Their service offerings are designed with this in mind, providing solutions to achieve financial well-being.

Le Prosperity Club a t cr pour des gens qui nont aucune exprience avec linvestissement. Notre mission est denrichir nos membres, mais aussi de leur donner les connaissances et les outils ncessaires pour bien comprendre leurs investissements. This statement speaks directly to the core principle of financial literacy. Regardless of prior experience, learning the basics is fundamental.

Here's a table detailing key information about the various types of financial assets.

| Asset Type | Description | Liquidity | Examples |

|---|---|---|---|

| Stocks | Ownership in a company. | High (easily converted to cash) | Shares of public companies |

| Bonds | Debt instruments issued by governments or corporations. | Moderate (can be sold on secondary markets) | Government bonds, corporate bonds |

| Mutual Funds | Pooled investments managed by professionals. | Moderate to High (easy to buy and sell) | Index funds, actively managed funds |

| Real Estate | Ownership of physical property. | Low (takes time to sell) | Residential, commercial properties |

| Cash Equivalents | Assets easily converted to cash. | High | Savings accounts, money market accounts |

The world of investing is diverse. It ranges from everyday transactions, where millions of trades are executed, to more unique assets that may be sold less frequently. The key is to find the investments that match your financial objectives. Whether you decide to use investment funds, which pool your money with other investors, or invest directly, a financial expert can help guide you.

The choice of how to invest depends on your individual needs, risk tolerance, and financial goals. Building a diversified portfolio, with a mix of assets, can help manage risk and increase the potential for positive returns. Remember, financial planning is a long-term process, and it's essential to continually assess your investments and goals, making adjustments as life changes occur.

In the realm of investments, understanding different asset classes is only the first step. Building a successful investment portfolio is a complex process. It requires in-depth research, a deep understanding of risk management, and the ability to make informed decisions. A diversified portfolio, constructed with a balance of stocks, bonds, and other investments, helps mitigate risk and maximize potential returns.

Prosperity Club, through Deborah Armstrong and her team, offers a variety of insurance products and aims to provide educational resources on investments, housing, insurance, and legal services. They are dedicated to helping individuals and families build a solid financial foundation.